The Value Losers Of The Bull Market | 10% To @tron-fan-club

Good evening, I hope everyone is doing very well at the Tron fan club. This has been a very interesting year in the market. BTC and the other leading tokens have been broken through historically important resistance in the last months. After that, most of the tokens are consolidating. So, some tokens have had a very bad week. They have lost ground and are declining. Today we will see some of these unfortunate events over the last 7 days.

|=====>ASTER<=====|

https://coinmarketcap.com/currencies/aster/

ASTER started with downward movement in the very beginning of the week. But on the middle of the week, it got support and started fluctuating. It recently slowed down the movement, and started gaining its strength back. The biggest falls happened on 17 October. It is currently at 1.13$, starting from 1.44$ only a week ago. As a result, it's down 22.7% over a week.

|=====>SNX<=====|

https://coinmarketcap.com/currencies/synthetix/

SNX was 1.97$ per coin only a week ago, faced a 21.2% lose in value over the last seven days. SNX started the week with steady bleeding movement. But luckily, it found support in middle of the week. Getting a little bit of strength SNX is now hovering just above the support level of 1.55$.

No words from this article should be taken as financial advice.

Thank You.

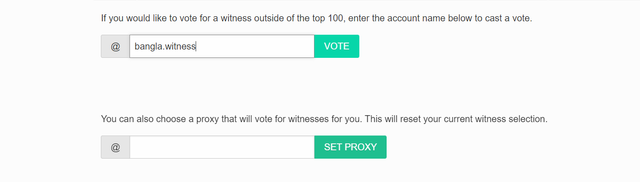

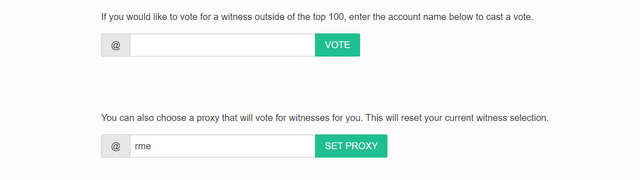

VOTE @bangla.witness as witness

OR

https://x.com/Arsalaan00070/status/1980710146772025616?t=1NTigv0HgnatVO0yLgg27g&s=19

This is a great post of The Value Losers Of The Bull Market.

An analysis of excellent quality @arsalaan 👏! I actually enjoyed your recap on the weekly performance of ASTER and SNX, as it provided the clear idea of how even during a booming market, certain tokens still have to endure difficult reprisals. The post was very informative to any person who was monitoring the market trends using the data and the particular movements of prices.

The end disclaimer was also a nice addition - the reminder that it is not financial advice is responsible and professional.

I like also your objective, calm way of describing the dips; it reveals that you are enlightened enough to realize the natural cycles in the market. This was a short yet very informative weekly report on the whole, good work, @arsalaan!