“Tron Among the Top 10 Growing Blockchains in 2025 – A Big Achievement”

Hello steem friends,

I hope you are all doing well. Today I want to share with you an interesting update about the fastest growing blockchains in 2025. As you know, the crypto industry is always changing, and new projects are coming out every year. But the real question is — which blockchains are people actually using?

In 2025, growth is no longer about hype or speculation, it’s about real usage and adoption. Millions of people are now active in DeFi, NFTs, stablecoins and even gaming projects. This shows us that blockchain is moving closer to real-life usage, not just trading.

The biggest factor that experts look at is the number of active users, meaning how many wallets are actually making transactions. This gives a clearer picture than just looking at token prices.

Another reason for fast growth is partnerships. Many blockchains are joining hands with big companies, gaming platforms, and even institutions that are investing through Bitcoin ETFs. This has created a fresh wave of adoption.

But of course, there are still challenges. Some blockchains inflate their numbers, some face scalability trade-offs, and regulations are becoming stricter in many countries. Also, the competition between L1 and L2 blockchains is very tough. For example, Ethereum is still strong as an L1, but L2 solutions like Polygon and Arbitrum are attracting millions of users due to cheaper transactions.

So, when we look at the Top 10 fastest growing blockchains of 2025, we see a mix of DeFi leaders, NFT-focused networks, and gaming chains. Each one is fighting to become the number one choice for users.

In short, the future of blockchain will not be decided by hype, but by real adoption, technology upgrades, and how many people actually use it daily.

That’s all for today, friends! Let me know in the comments which blockchain you think will dominate in the coming years.

Top 10 fastest-growing blockchains

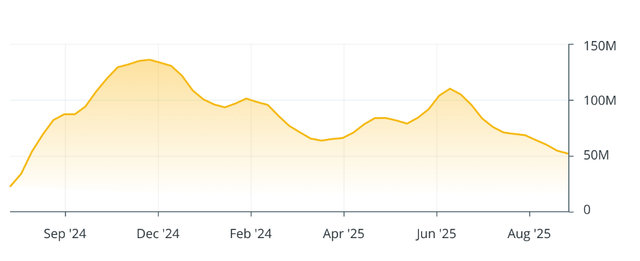

1. Solana

Solana is a high-speed L1 blockchain with a proof-of-history (PoH) consensus mechanism, designed for scalable decentralized applications (DApps) and marketplaces.

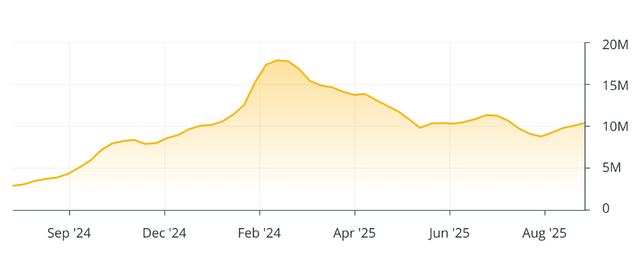

Monthly active users: 57 million

FDV: $107.2 million

Token trading volume (30 days): $284.2 billion

Key drivers: Solana’s growth has been fueled by DeFi and NFTs, a surge in high-frequency trading of memecoins, the Firedancer validator client boosting reliability and increasing institutional adoption.

Challenges: Past network outages affect reliability. Other challenges include criticism regarding the degree of centralization and competition from L2 solutions.

Did you know?

Solana’s proof-of-history lets it process thousands of transactions per second, powering DeFi, NFTs and even memecoin trading at lightning speed.

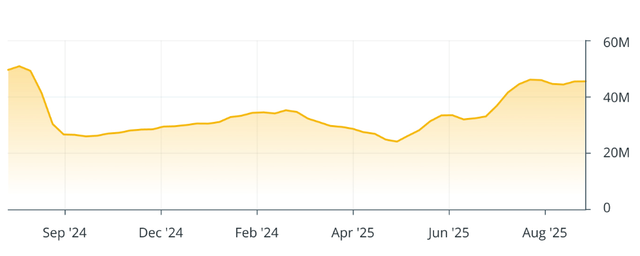

2. BNB Chain

BNB Chain is a Binance-backed L1 blockchain supporting DeFi, NFTs and DApps with Ethereum Virtual Machine (EVM) compatibility.

Active addresses (monthly): 46.4 million

FDV: $121.2 billion

Token trading volume (30 days): $56.1 billion

Key drivers: Reduced block time to 0.75 seconds, AI integrations for data ownership.

Challenges: Centralization concerns due to backing of Binance, regulatory scrutiny.

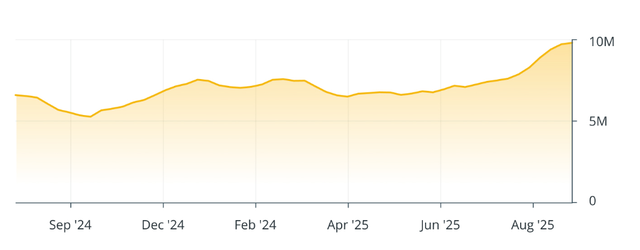

3. Ethereum

Ethereum is a leading L1 blockchain for smart contracts, DeFi and NFTs, with a vast developer ecosystem using a proof-of-stake (PoS) consensus.

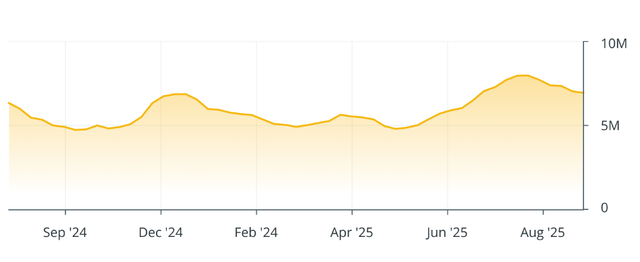

Active addresses (monthly): 9.6 million

FDV: $522.7 billion

Token trading volume (30 days): $1.1 trillion

Key drivers: Pectra upgrade for better UX and scalability, ETF inflows and institutional staking.

Challenges: Scalability issues, higher fees than rivals and regulatory pressures.

4. Bitcoin

Bitcoin is the original decentralized cryptocurrency using proof-of-work (PoW) consensus. It serves as digital gold for store-of-value and payments.

Active addresses (monthly): 10.8 million

FDV: $2.3 trillion

Token trading volume (30 days): $1.3 trillion

Key drivers: Institutional inflows via exchange-traded funds (ETFs). (As of Q4 2024, professional investors with over $100 million under management hold Bitcoin ETFs worth $27.4 billion.) Reduced supply due to halving events and adoption as a strategic reserve.

Challenges: High energy consumption; volatility from macroeconomic factors.

5. Base

Coinbase developed Base, an Ethereum L2 blockchain using optimistic rollups, focusing on low-cost DeFi, consumer apps and seamless integration.

Active addresses (monthly): 21.5 million

FDV: $2.92 billion

Key drivers: Ultra-low fees ($0.01 average), Coinbase’s 100 million+ user base for onboarding, stablecoin flows and partnerships for consumer DApps.

Challenges: Network congestion from high activity, dependence on Ethereum for security and regulatory compliance as a newer ecosystem.

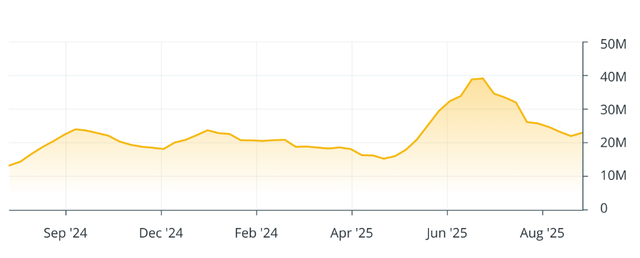

6. Tron

Tron is a high-throughput L1 blockchain focused on decentralized content sharing and integration with Telegram and emphasizes low-cost stablecoin transactions.

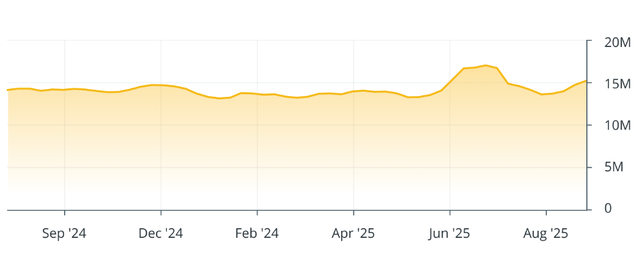

Active addresses (monthly): 14.4 million

FDV: $33.5 billion

Token trading volume (30 days): $51.7 billion

Key drivers: Negligible transaction fees, AI and cross-chain integrations and partnerships like with Rumble Cloud.

Challenges: Regulatory scrutiny, centralization risks.

7. Arbitrum One

Arbitrum One is a leading Ethereum L2 using optimistic rollups for faster, cheaper transactions while inheriting Ethereum’s security.

Active addresses (monthly): 4 million

FDV: $5.1 billion

Token trading volume (30 days): $14.3 billion

Key drivers: Integrations like Robinhood for tokenized assets and upgrades like Stylus for lower fees.

Challenges: Dependence on the Ethereum mainnet, regulatory uncertainty and competition from Optimism.

8. Aptos

Aptos is an L1 blockchain by ex-Meta engineers using the Move language, emphasizing scalability, DeFi and developer growth for DApps.

Active addresses (monthly): 10 million

FDV: $5.3 billion

Token trading volume (30 days): $13 billion

Key drivers: Peak 19,200 TPS; Move language for secure contracts; partnerships like Tether’s USDt

Challenges: Needs broader adoption and competition from established L1s.

9. Polygon

Polygon offers a multichain scaling solution for Ethereum using PoS, supporting DeFi, NFTs and enterprise apps with EVM compatibility.

Active addresses (monthly): 7.2 million

FDV: $2.6 billion

Token trading volume (30 days): $4.2 billion

Key drivers: Upgrades like Heimdall v2 for interoperability and partnerships with Fortune 500 firms.

Challenges: Regulatory scrutiny under Markets in Crypto-Assets (MiCA) and competition from other L2s.

10. Near Protocol

Near Protocol is a layer-1 blockchain using a thresholded proof-of-stake (TPoS) consensus. It focuses on scalability, developer-friendly tools and integration of AI-native features for decentralized applications.

Active addresses (monthly): 51.2 million

FDV: $3.1 million

Token trading volume (30 days): $7.8 million

Key drivers: AI integration for user-owned agents and intents, low transaction fees with carbon neutrality, partnerships like with EigenLayer for fast finality and ecosystem expansions in DeFi and gaming.

Challenges: Competition from faster L1s and L2s, price volatility despite user growth and potential vulnerabilities in sharding complexity.

Congratulations!

Your post has been manually upvoted by the SteemPro team! 🚀

This is an automated message.

If you wish to stop receiving these replies, simply reply to this comment with turn-off

Visit here.

https://www.steempro.com

SteemPro Official Discord Server

https://discord.gg/Bsf98vMg6U

💪 Let's strengthen the Steem ecosystem together!

🟩 Vote for witness faisalamin

https://steemitwallet.com/~witnesses

https://www.steempro.com/witnesses#faisalamin

Please go through the pinned posts in the community to know the rules of the community. After knowing the rules post here. If you don't understand any part feel free to create support ticket in https://discordapp.com/channels/930834672416604173/930841458787901480

I didn't find any rule breaking context in my post . I read the rules earlier . If you found something you can tell me. Nice to meet you!