The Thriving Landscape Of The UAE Automotive Aftermarket Service Industry: Trends, Challenges, And Opportunities

The UAE automotive aftermarket is witnessing robust growth, significantly driven by increasing vehicle ownership and consumers' preferences for enhanced vehicle maintenance. As of recent reports, the market size is projected to grow remarkably, reflecting a shift towards quality service options and premium parts. This sector's attractiveness is amplified by the diverse range of services offered, including repair, maintenance, and parts replacement.

- Current Market Size: The UAE automotive aftermarket was valued at approximately USD 8 billion in 2021, with a forecasted compound annual growth rate (CAGR) exceeding 5% over the next few years, indicating substantial expansion potential.

- Growth Drivers: Key factors driving growth include the rising population in urban areas, increasing disposable income, and the expansion of car ownership, leading to higher demand for maintenance and repair services.

- Trends in Consumer Behavior: Consumers increasingly prefer high-quality aftermarket products and services, creating opportunities for service providers to cater to a more discerning customer base seeking reliability and performance enhancements.

- Market Challenges: Despite the positive outlook, challenges such as competition from OEM (Original Equipment Manufacturer) services and the need for skilled labor can hinder expansion, requiring strategic focus from aftermarket players to differentiate their offerings.

The UAE automotive aftermarket represents a dynamic sector with significant growth potential, marked by evolving consumer expectations and market trends. Stakeholders should be prepared to navigate this evolving landscape to capitalize on emerging opportunities.

For a deeper look at how the UAE automotive aftermarket service industry stacks up against neighboring markets, explore the UAE Automotive Aftermarket Service Industry. The report covers growth projections, consumer sentiment, and competitive positioning in depth.

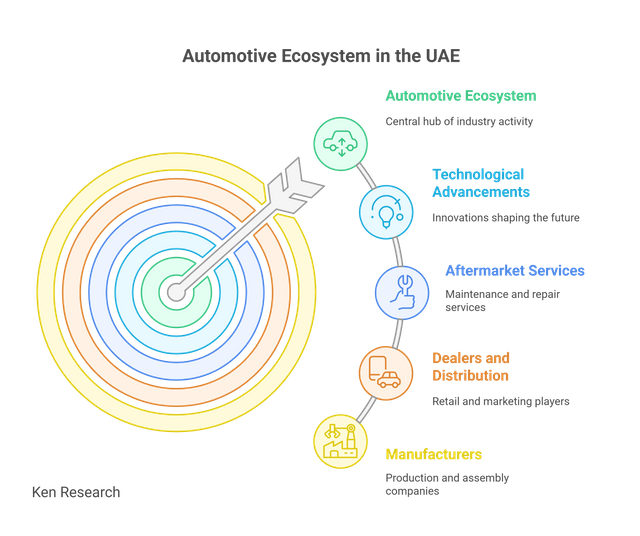

The Automotive Ecosystem in the UAE

The automotive ecosystem in the UAE is characterized by a complex interplay among manufacturers, suppliers, dealers, and service providers. This vibrant industry is not only significant for the economy but also reflects the changing consumer preferences and technological advancements.

- Manufacturers: Leading automobile companies, including global giants such as Toyota, Nissan, and BMW, have established production facilities and strong sales in the UAE. The emphasis on local assembly and partnerships with local firms enhances market responsiveness and contributes to job creation.

- Dealers and Distribution: The UAE boasts a robust network of car dealerships offering a wide range of vehicle brands. Many dealers engage in aggressive marketing strategies and attractive financing options to capture consumer interest, leading to a highly competitive retail environment.

- Aftermarket Services: The burgeoning automotive aftermarket service industry is crucial for vehicle maintenance and repair. Services include routine maintenance, collision repairs, and the installation of aftermarket components, which are indispensable as vehicle ownership increases.

- Technological Advancements: Innovations such as electric vehicles (EVs), autonomous cars, and connected vehicle technology are gaining traction. The UAE government supports this shift through initiatives promoting sustainability and smart mobility, further shaping the future landscape of the automotive ecosystem.

This dynamic automotive ecosystem showcases the interplay of various players contributing to a thriving industry in the UAE, with a focus on innovation and responsiveness to consumer needs.

To understand how premium automakers tailor product mixes in Asia, review the India Automotive Aftermarket. It details market-entry tactics, after-sales innovations, and partnership models proven to build brand equity.

Future Outlook and Trends

The future of the UAE automotive aftermarket is poised for significant evolution driven by technological advancements, shifting consumer behaviors, and dynamic regulatory influences. As the region embraces modernization, the following key trends are expected to shape the automotive landscape.

- Technological Innovations: The integration of advanced technologies such as artificial intelligence (AI) and Internet of Things (IoT) is revolutionizing the aftermarket. These technologies facilitate smarter diagnostics, predictive maintenance, and enhanced customer experience, leading to increased operational efficiency and customer satisfaction.

- Shift in Consumer Preferences: Consumers are increasingly leaning towards online platforms for vehicle maintenance services. The rise of e-commerce in the automotive space not only allows for greater convenience but also encourages competitive pricing and services tailored to customer demands.

- Sustainability and Regulations: Growing environmental concerns are pushing for stricter regulations in the automotive sector. The UAE government is actively promoting initiatives for sustainable practices in automotive services, which includes the adoption of greener technologies and practices that reduce carbon emissions from vehicles.

- Electric Vehicles (EV) Expansion: The increasing adoption of electric vehicles (EVs) is set to create new opportunities within the aftermarket. This shift requires service providers to adapt to different maintenance protocols and invest in specialized training and tools, promoting a new market segment focused on EV servicing and repair.

The convergence of these trends indicates a transformative era for the UAE automotive aftermarket. Companies that strategically embrace these changes will be best positioned for growth and competitiveness in the evolving market landscape.

For insights on similar markets, refer to the USA Automotive Aftermarket Industry report. This analysis provides a comprehensive overview of trends and growth opportunities in the automotive sector.

Challenges and Opportunities in the UAE Automotive Aftermarket Sector

The UAE automotive aftermarket sector faces several challenges that could hinder its growth and innovation potential. However, these challenges also present opportunities for businesses willing to adapt and invest.

- Market Competition: The influx of international brands poses a significant challenge to local players, forcing them to innovate continuously to retain market share. Local companies must focus on enhancing customer service and expanding their product offerings to stand out in a competitive landscape.

- Technological Advancements: Rapid advancements in automotive technology, such as electric and autonomous vehicles, require significant investments in training and equipment. Companies must invest in technology upgrades and staff training to meet changing consumer expectations and regulatory requirements.

- Supply Chain Disruptions: The aftereffects of global supply chain issues can significantly impact parts availability and operational efficiency. Businesses need to implement robust risk management strategies to navigate fluctuations in supply and demand effectively.

- Regulatory Challenges: Compliance with changing regulations and standards creates obstacles for businesses. Staying ahead of regulatory changes and investing in compliance can provide a competitive edge, fostering customer trust and loyalty.

Despite these challenges, numerous opportunities for growth and innovation exist within the sector:

- Digital Transformation: Embracing digital technologies such as e-commerce and online service booking can enhance customer engagement and streamline operations. Companies that leverage online platforms can tap into a broader customer base and improve service delivery.

- Sustainable Practices: The shift towards sustainability offers new avenues for businesses. Adopting environmentally friendly practices and promoting eco-friendly products can appeal to the growing customer segment focused on sustainability.

- Aftermarket Services Expansion: There is a rising demand for value-added services such as vehicle customization and maintenance packages. Companies can capitalize on this trend by offering tailored services that meet specific customer needs, thus increasing customer retention and loyalty.

- Investment in Research and Development: Innovating new products or services tailored to local preferences can drive market differentiation. Investing in R&D can lead to unique offerings that address specific gaps in the market, enhancing competitive advantage.

In conclusion, although the UAE automotive aftermarket sector confronts numerous challenges, the pathway is paved with distinctive opportunities for companies prepared to innovate and adapt. To learn more about the dynamics shaping this market, explore the Ksa Automotive Aftermarket Market.

Introduction to the UAE Automotive Aftermarket Service Industry

The UAE automotive aftermarket service industry is a pivotal component of the region's economy, reflecting not only the growth of vehicle ownership but also the evolving consumer preferences concerning vehicle maintenance and enhancement. Comprising a diverse range of services and products, including parts replacement, vehicle accessories, and repair services, the aftermarket is crucial for sustaining vehicle performance and safety.

- Market Growth: The UAE's automotive aftermarket is driven by a robust increase in vehicle registrations, with an expected compound annual growth rate (CAGR) of over 5% in the coming years. This growth can be attributed to rising disposable incomes and urbanization, which prompt consumers to invest in vehicle upkeep and personalization.

- Consumer Trends: Modern consumers in the UAE are increasingly aware of the importance of regular maintenance and quality parts, influencing their purchasing decisions. There is a notable shift towards online platforms for service booking and purchasing aftermarket parts, reflecting a broader trend of e-commerce integration in automotive services.

- Key Players and Competition: The market is characterized by the presence of numerous players, ranging from independent workshops to authorized service centers. Competitors are continually enhancing their service offerings and optimizing supply chains to meet consumer demand and improve service delivery efficiency.

- Technological Integration: The advent of advanced technologies, such as diagnostics tools and automotive software, is transforming service delivery in the UAE. Incorporating telematics and data analytics aids service providers in predicting maintenance needs and delivering personalized consumer experiences.

The UAE automotive aftermarket service industry is set to evolve further, offering vast opportunities for stakeholders willing to adapt to changing consumer expectations and technological advancements.

For broader global context on automotive aftermarket trends, consult the USA Automotive Aftermarket Industry, featuring forecasts, tech roadmaps, and regulatory shifts shaping demand worldwide.

Market Size and Dynamics

The UAE automotive aftermarket service industry has witnessed substantial growth, driven by increasing vehicle ownership, rising disposable incomes, and a growing emphasis on vehicle maintenance and safety. As the population of vehicles continues to rise, the demand for aftermarket services such as repairs, parts replacement, and accessories is expected to grow significantly.

- Market Growth: The UAE automotive aftermarket is projected to expand at a compounded annual growth rate (CAGR) of over 6% by 2025. This growth is influenced by the increasing complexity of vehicles and the resultant demand for specialized services.

- Key Players: Major players in the market include Al-Futtaim, Arabian Automobiles, and AAD, which dominate due to their extensive service networks and brand loyalty. These companies are focusing on enhancing customer experience through technology integration.

- Trends Driving Growth: The rise of online service booking platforms and mobile apps is revolutionizing how consumers access aftermarket services. Additionally, a growing trend toward green vehicles is pushing companies to develop eco-friendly service options.

- Technological Advancements: The implementation of advanced diagnostic tools and technologies enhances service quality. Companies are investing in training their workforce on the latest automotive technologies to meet consumer expectations effectively.

As the automotive landscape continues to evolve, the aftermarket sector is positioned to capitalize on new opportunities. Market participants are advised to keep an eye on emerging trends and consumer preferences to stay competitive.

For insights on similar markets, refer to the India Automotive Aftermarket report. This analysis provides a comprehensive overview of trends and growth opportunities in the automotive sector.

Ecosystem and Stakeholders

The UAE automotive aftermarket is a complex ecosystem consisting of a diverse range of stakeholders, each playing a pivotal role in maintaining and enhancing the automotive services and products landscape. This intricate network is essential for understanding market dynamics, competition, and collaborations that drive profitability and growth.

- Manufacturers and OEMs (Original Equipment Manufacturers): They form the backbone of the aftermarket ecosystem, supplying quality parts and components necessary for vehicle maintenance and repair. Strong partnerships with local and international manufacturers are critical to ensuring a diversified product range and competitive pricing.

- Distributors and Wholesalers: Acting as intermediaries, these entities facilitate the flow of automotive parts from manufacturers to retailers and service centers. They are essential for maintaining inventory levels and ensuring timely delivery of products across regions, impacting the overall supply chain efficiency.

- Retailers and Service Centers: These stakeholders provide end-user access to automotive products and repair services. Retailers often leverage technology to enhance customer experience, while service centers rely on skilled labor and quality parts to build trust and retain customers. A robust relationship with suppliers is crucial for maintaining service quality.

- Consumers: The ultimate end-users of automotive aftermarket products and services, consumers today are increasingly educated and price-sensitive. Their preferences significantly influence market trends, with a rising demand for sustainable and high-performance products driving innovation in the industry.

Understanding these stakeholder dynamics is essential for navigating the UAE automotive aftermarket landscape, allowing companies to identify opportunities for collaboration and growth.

To explore the comprehensive analysis of the automotive aftermarket landscape, refer to the Ksa Automotive Aftermarket Market. This report elaborates on the roles each player undertakes within the broader ecosystem.

Future Outlook and Growth Opportunities

The UAE automotive aftermarket service industry is poised for significant growth, driven by technological advancements and expanding market potentials. As more vehicles enter the market and technological innovations continue to emerge, the sector is set to flourish.

- Technological Integration: The integration of advanced technologies such as IoT and AI in automotive services is optimizing operations. This transformation is enhancing efficiency, reducing costs, and improving customer experiences, leading to increased demand for tech-driven service solutions.

- Electric Vehicle Market Expansion: With a global shift towards sustainability, the rise of electric vehicles (EVs) is creating new opportunities within the aftermarket. The UAE government's initiatives to promote EV adoption are expected to open up niche market segments for parts and services tailored to electric and hybrid vehicles.

- Investment in Infrastructure: Significant investments in automotive infrastructure, such as service centers and repair shops, are anticipated to support the aftermarket sector. As the industry continues to modernize, upgrading facilities to accommodate advanced repairs and maintenance will be crucial.

- Consumer Trends: Increasing consumer preferences for high-quality service and personalized care are driving service providers to enhance their service offerings. This trend emphasizes the need for comprehensive service packages that cater to a discerning clientele, presenting a growth avenue for businesses in the aftermarket.

The convergence of these factors indicates a robust future for the UAE automotive aftermarket, where businesses can leverage emerging opportunities to capitalize on market growth.

For broader global context on automotive aftermarket trends, consult the USA Automotive Aftermarket Industry, featuring forecasts, tech roadmaps, and regulatory shifts shaping demand worldwide.

The Current Landscape of the UAE Automotive Aftermarket Service Industry

The UAE automotive aftermarket service industry is experiencing robust growth, buoyed by increasing vehicle ownership and a focus on vehicle maintenance. As of recent analyses, the market is projected to expand significantly, driven by various factors including a growing population and urbanization trends.

- Market Size and Growth: The UAE automotive aftermarket service industry is valued significantly and is expected to grow in the coming years, supported by increased consumer spending on vehicle repairs and maintenance. This growth reflects the rising population and the influx of expatriates driving higher vehicle ownership rates. According to insights, the market could witness a substantial compound annual growth rate (CAGR) as more consumers opt for quality aftermarket services.

- Segmentation Insights: The market can be segmented into various categories such as parts, services, and accessories. The parts segment includes tires, batteries, and other essential components necessary for vehicle upkeep. Meanwhile, the services segment, which encompasses routine maintenance, repairs, and customizations, is gaining traction as vehicle owners prioritize reliability and performance.

- Technological Advancements: Innovation plays a crucial role in transforming the aftermarket landscape. With the introduction of digital tools and mobile applications for service scheduling, consumers can now easily access a range of services. This has led to enhanced customer experiences, reduced wait times, and optimized service delivery, positioning businesses to meet evolving demands effectively.

- Challenges and Opportunities: Despite the growth potential, players in the UAE automotive aftermarket face challenges such as increased competition and pricing pressures. However, opportunities abound for businesses that focus on quality, customer service, and technological advancements. Adapting to consumer needs and trends will be critical for sustained success in this dynamic market.

As the UAE automotive aftermarket service industry evolves, stakeholders must stay ahead of market trends and consumer preferences to capture growth opportunities and enhance service offerings.

For further insights on automotive markets in the region, refer to the Ksa Automotive Aftermarket Market.

Key Players and Their Roles: Understanding the Ecosystem

The UAE automotive aftermarket service industry is a complex ecosystem comprising various key players, each contributing significantly to its functionality and growth. Understanding these players and their roles is essential for stakeholders to navigate this dynamic market effectively.

- Original Equipment Manufacturers (OEMs): OEMs play a critical role by providing quality parts and services, often ensuring that replacement components meet the vehicle manufacturers' specifications. Their involvement guarantees reliability and performance, bolstering consumer trust in the aftermarket options available.

- Independent Workshops and Service Centers: These entities offer competitive pricing and localized services, catering mainly to post-warranty vehicle owners. They often specialize in various repairs and customizations, filling the gap that OEM service centers may leave due to high costs or luxury vehicle focus.

- Parts Manufacturers and Suppliers: This segment consists of both original and aftermarket parts providers. They are crucial in maintaining a steady flow of components into the market, helping to reduce costs by promoting competition and offering solutions that may enhance vehicle performance and lifespan.

- Distributors and Retailers: Distributors facilitate the supply chain from manufacturers to end-users, while retailers provide direct access to consumers. These players are pivotal in enhancing market accessibility and ensuring that a diverse range of products is readily available to vehicle owners.

Furthermore, understanding the interconnections among these key players allows for improved strategies and collaboration opportunities in the expanding automotive aftermarket.

To explore the comprehensive analysis of the automotive aftermarket landscape, refer to the Ksa Automotive Aftermarket Market, which elaborates on these dynamics and the roles each player undertakes within the broader ecosystem.

Future Trends and Market Outlook: What Lies Ahead for the Automotive Aftermarket

The UAE automotive aftermarket service industry is poised for transformative changes driven by technological advancements and evolving consumer demands. Understanding these trends is crucial for stakeholders looking to seize opportunities and adapt to this dynamic landscape.

- Technological Innovations: The rise of connected vehicles is revolutionizing how consumers interact with their vehicles. Advanced telematics systems can provide real-time diagnostics, facilitating predictive maintenance and minimizing downtime. The integration of AI and machine learning into service frameworks is expected to enhance customer experiences and operational efficiencies.

- Growth of E-Commerce Platforms: There is a marked increase in the adoption of digital platforms for purchasing spare parts and services. E-commerce solutions not only streamline the buying process but also provide competitive pricing and wider selections. Customers are gravitating towards convenient online solutions, prompting traditional service providers to enhance their digital presence.

- Enhanced Customer Service: Consumer expectations are shifting toward personalized and responsive service. The implementation of customer relationship management (CRM) systems allows businesses to engage customers better, offering tailored services that cater to individual needs. Feedback loops and service quality assessments are becoming vital to maintain customer loyalty.

- Sustainability Initiatives: As environmental concerns grow, there is a push for sustainable practices within the automotive aftermarket. Companies are adopting eco-friendly products and services, such as bio-based lubricants and recycled parts, to meet regulatory standards and consumer preferences for sustainability.

As these trends unfold, stakeholders in the automotive aftermarket must remain agile and informed. Proactive engagement with emerging technologies and shifting consumer behaviors will be key to capturing market share and sustaining growth in this evolving sector.

For broader global context on automotive aftermarket trends, consult the USA Automotive Aftermarket Industry, featuring forecasts, tech roadmaps, and regulatory shifts shaping demand worldwide.

Conclusion

In summary, this article covers the latest trends, key drivers, and opportunities in the market. For more in-depth research, explore our related reports.