Insurance Tips for Water Damage Claims in Australia

Insurance Tips for Water Damage Claims in Australia

Discovering water damage in your home is stressful enough—navigating the insurance process shouldn’t add to the headache.

Follow these key steps to secure a smooth claim and protect your finances.

1. Act Fast and Stop the Source

- Shut off mains water if a burst pipe is suspected.

- Take immediate measures to prevent further damage, such as moving furniture or covering exposed areas.

Quick action not only reduces repair costs but also strengthens your insurance position.

2. Document Everything

- Take clear photos and videos of the affected areas before any cleanup.

- Keep receipts for emergency repairs or equipment rentals (fans, dehumidifiers).

- Note the date and time of discovery—insurers require a clear timeline.

3. Contact Your Insurer Early

Call your insurer as soon as possible and provide:

- Policy number

- Description of the incident

- Initial estimate of damage

Ask for a claim number and the name of your claims officer for reference.

4. Understand Your Policy

Policies often differ in:

- Coverage for gradual leaks versus sudden bursts

- Limits on carpet replacement

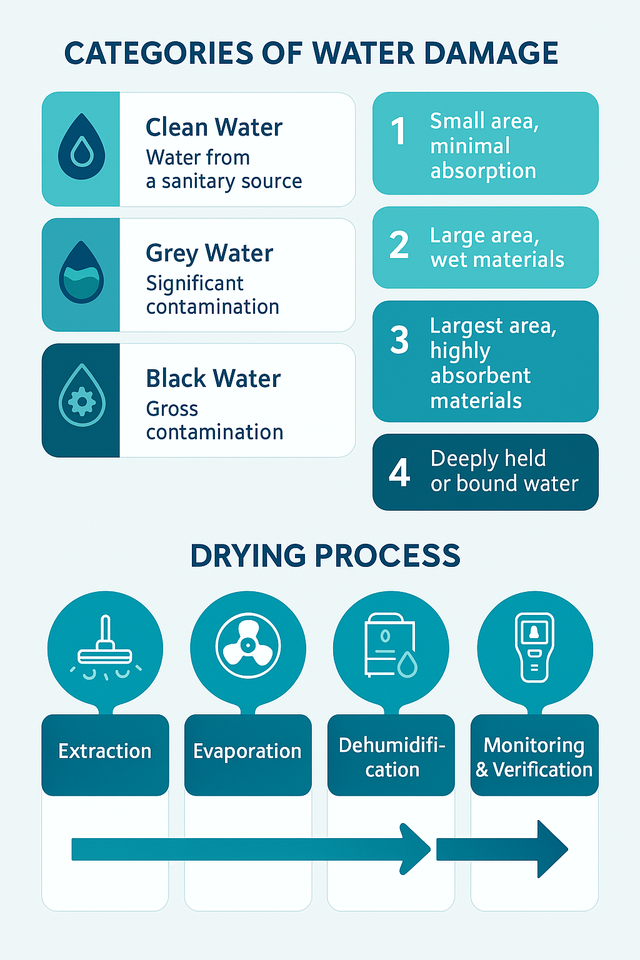

- Requirements for professional drying

Knowing these details helps avoid surprises during settlement.

5. Use Certified Professionals

Insurance companies prefer IICRC-certified contractors like Reztor Restoration.

They provide:

- Detailed moisture reports

- Photographic evidence

- Standards-based drying documentation for your claim file

Key Takeaways

- Document first, clean later.

- Communicate early with your insurer.

- Hire certified restorers to validate drying and avoid claim rejections.

✅ Need Immediate Help?

For insurance-ready reports and 24/7 emergency drying, contact Reztor Restoration.